Post Market Report

26 July 2024 Ko Indian Stock Market Mein Big Up Side Move Dekhne Ko Mila Jaha Pe Sensex Ki Expiry Thi Aur Sensex mein 1292 Point Big Up side Rally Dekhne Ko Mili Sensex Mein 29 Company Positive Mein Trade Ki aur Nifty 50 Bhi 428 Point ka up Side trending Move Di aur Apne All time High PE Trade Ki

SENSEX Summary

26 july 2024 Ko Sensex Ki Expiry Thi Jisme Sensex Ka Call Side ka Premium Increase Hua Aur Sensex Spot Ne 1292 Ka Up side Move Dekar 81,332 Pe Clossing Di Sensex Ka Daily Range 80,013 Se 81,427 Ke Range Mein Trade kiya Aur Sabhi Sector Sensex Me Bullish The

OPEN-80,158 LOW -80,013 HIGH-81427 CLOSE – 81,332

- SENSEX Top Gainer

| STOCKS | PRICE | CHANGE% |

| Bharti Airtel | ₹1514.70 | 4.51% |

| Adani Port | ₹1541.15 | 3.61% |

| Tata Steel | ₹162.60 | 3.27% |

| Jsw Steel | ₹900.30 | 2.96% |

- Sensex Only 1 stock Nestle Minor Negative -0.15%

NIFTY BANK REPORT

26 july 2024 Ko Nifty Bank Gap Down Open Hua Aur 1.5 Hr Sideways Range mein Trade Kiya Jab Range Ka High Break Hua Toh Bank nifty up side rally ki 51,398 ka High Lagaya Aur Banknifty Ki Clossing 51,295 Pe Hui Aur Nifty Bank Ka Daily Rnage 50,438 se 51,398 ke Range Mein Trading Hui Bandhan Bank 3.59% And Kotak Bank 2.18% Ki Rally Di

Nifty Bank OHLC

OPEN :-50,456 , HIGH:-51,398 ,LOW:-50,438 , CLOSE -51,295

Nifty Bank Top Gainer

| Stocks | Price | Change% |

| Bandhan Bank | ₹192.50 | 3.59% |

| Kotak Bank | ₹1813.85 | 2.18% |

| Au Small Finance | ₹650.40 | 2.97% |

Nifty Bank Top Losers

| STOCKS | PRICE | CHANGE% |

| Federal Bank | ₹198 | -3.26% |

| IDFC First Bank | ₹74.48 | -0.24% |

NIFTY50 REPORT

26 July 2024 Ko Nifty Mein Big Upside Trending Move Aayi Aur Nifty Apne Low Se 428 Point Uppar 24,834 Pe Closing Diya Nifty Ne apna All Time High Ko Break Kiya Nifty Mein Finance And Telecom And Hospital Sector Very Bullish The Shriram Finanace ne 9.18% And Bharti Airtel 4.50% And Apollo Hospital Ne Bhi 4.37% Ka up side Move Diya Nifty Ka Daily Clossin 1.76% Up me hua Nifty Me 50 Company Mein Se only 3 company Negative Mein Close Kiya

NIFTY 50 TOP Gainer’s

| STOCKS | PRICE | CHANGE% |

| Shriram Finance | ₹2,925 | 9.18% |

| Divis Lablotries | ₹4,790.60 | 5.36% |

| Cipla | ₹1,575 | 5% |

| Bharti Airtel | ₹1,514.40 | 4.5% |

NIFTY 50 TOP LOOSER

| Stocks | Price | Change% |

| ONGC | ₹331.60 | -1.81% |

| TATA CONSUMER PRODUCT | ₹1,213.65 | -0.81% |

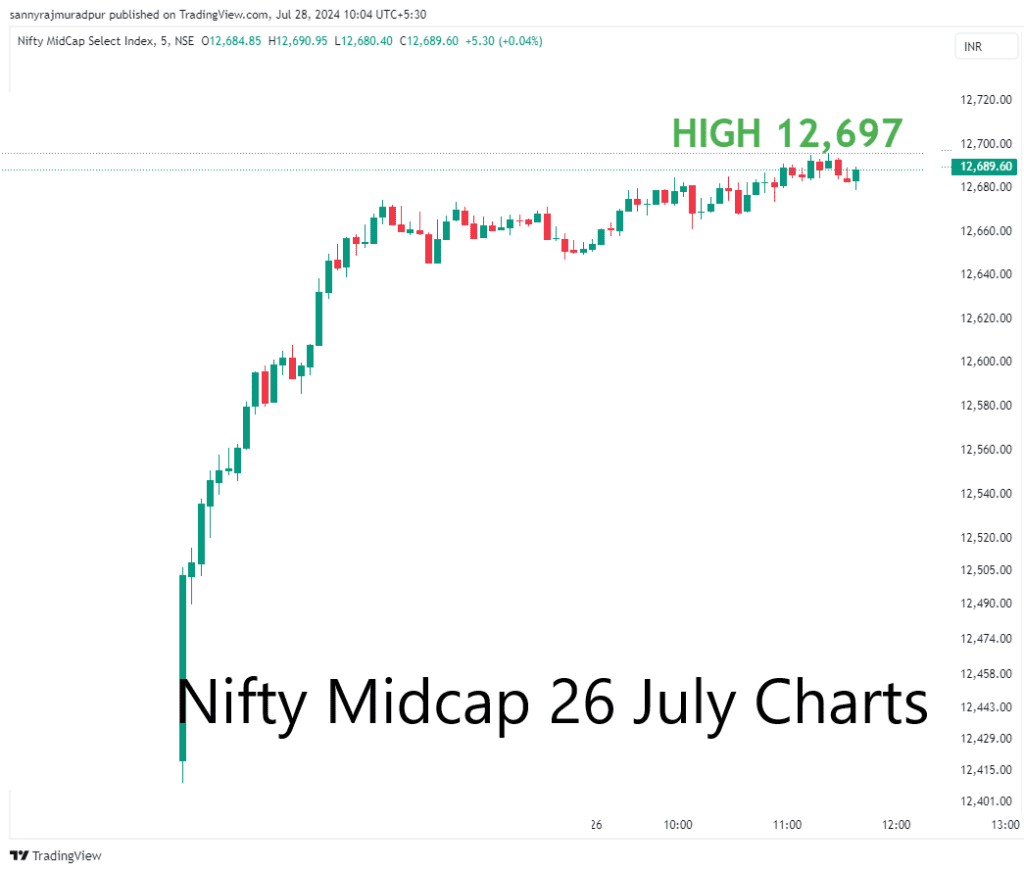

Nifty MIDCAP Summary

26,July 2024 Ko Nifty Midcap Mein Very Big Up Side Move Aayi Nifty Midcap Ne 269 Point (2.17%) Ka Move Diya Midcap Ne Apna All Time high Break Kiya Aur Naya High 12,697 Ka lagaya Hai Midcap Ka Daily Range 12,410 se 12,697 Ka Range Mein Trade Kiya Midcap Ke Many Stock Very Bulish The Jisme

MIDCAP OHLC

Open:-12,418 , High:- 12.697 ,Low:-12,410 , Close:-12,687

- MIDCAP Top Gainer

| STOCKS | PRICE | CHANGE% |

| MPHASIS | ₹3,029.80 | 6.51% |

| ASHOK LEYLEND | ₹246.38 | 6% |

| Bharat Forge | ₹1,684.90 | 5.81% |

| Vodafone -IDEA | ₹15.98 | 5.27% |

- MIDCAP Top Looser

| Stocks | Price | Change% |

| Federal Bank | ₹198 | -3.26% |

| IDFC Bank | ₹74.48 | -0.24% |

ALL Stock Top Gainer

| Stock | LTP | Change | Change% |

| New India Assurance Company | 291.73 | 33.29 | 12.88% |

| PAYTM | 509.05 | 46.25 | 9.99% |

| Shriram Finance | 2925 | 246 | 9.18% |

| Network 18 Media | 91.59 | 7.28 | 8.63% |

| Solar Industries | 10,966.80 | 772.25 | 7.57% |

ALL Stock Top Looser

| Stock | LTP | Change | Change% |

| United Breweries | 2,037 | -72.225 | -3.43% |

| Federal Bank | 198 | -6.67 | -3.26% |

| United Sprit | 1,415.40 | -28.40 | -1.97% |

| ONGC | 331.60 | -4.20 | -1.25% |

| Sbi Cards | 721.70 | -8.80 | -1.20% |

| Category | Date | Buy Value (CR) | Sell Value (CR) | Net Value(CR) |

| FII | 26 JULY 2024 | ₹18,201.30 | ₹15,654.92 | ₹2546.38 |

| DII | 26 JULY 2024 | ₹18,856.44 | ₹16,082.13 | ₹2,774.71 |

FII AND DII SUMMARY

- Foreign Institutional Investor (FII) NE AAJ 26TH JULY 2024 KO NET ₹2546Cr Ki Indian Market Mein Buying Ki

- Domestic Institutional Investor(DII) Ne Aaj 26TH JULY 2024 KO Net ₹2,774Cr Ki Indian Market Me Buying Kari

- Both Participants Ne 26 July ko Market Mein Buying Ki

- Notes

- Today Market Are Very Bullish Traded Nifty and MIIDCAP Break All Time High

- Solar And Battery Sector Very Bullish

- Both Participants ne market mein buying kiya

- Tomorrow Midcap And Bankex Expiry

- Monday ko Midcap And Bankex Ki Expiry Hai Safe Trade Kare

- Shriram finance top gainer of Nifty

- Morning Me Watch Gift Nifty And Global Index To Make A market Plan

This Article Is Only For Education Purpose

Disclaimer- This article is for educational purposes only. Do not invest your hard-earned money without consulting your financial advisor and conducting your analysis.